AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine, Econometrics, and Dominance Analysis in Q4 2023 - Part 2

Stocks across all sectors, especially in Tech, Healthcare, Financial Services, Energy, and Consumer have been delivering differential returns over the last years including in 2021, 2022, and Q1- early Q4 2024. Most stocks reached heights in December 2021. Then, in 2022 and up to mid-Q1 2023, the stock growth became broadly negative across most sectors, except energy. The major stock market indices were also impacted. Since then, many stocks across all sectors, along with the key market indices have been on the rise, on a path to reaching the 2021 levels. In a sample of key stocks to watch, as identified by AroniSmart™ team, leveraging the Machine Learning, Econometrics, and NLP capabilities AroniSmartIntelligence™ and AroniSmartInvest™, most stocks have shown resilience and sometimes outperforming most of the other stocks and the key stock market indices. As the end of Q4 2023 is reached , almost all the stocks, along with the key indices have reached highs, even aiming at their record highs.

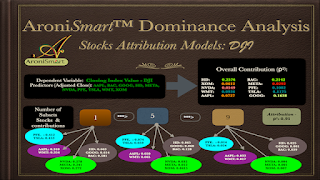

AroniSmart™ team, leveraging the Machine Learning Time Series capabilities, including Support Vector Machine, and Dominance Analysis of AroniSmartIntelligence™ and AroniSmartInvest™, has looked at the trends of the stock prices of 21 selected companies between Q4 2021 and Q4 2023 and came up with insights and projections on the dynamics. This is the Part 2 of the analysis. The findings captured in Part 1 may be seen here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 1.

Part 2 insights are presented below (for disclaimer and terms, check AroniSoft website).

A little bit of the usual investment research before coming back to AroniSmart™'s findings.

In Part 1, it was shown that most of the stocks experienced a positive growth for 2023 vs Dec 2021. Only a very few stocks like NVDA, XOM, UBER had showed a momentum. However, compared to Dec 2022, most stocks have gained a positive momentum, especially the technology stocks such as AAPL, GOOG, TSLA, META, NVDA, AMD, SOFI, NFLX and others such as UBER, and ABNB. Several stocks, especially in Healthcare and Banking have been on a downward trend. The sample included PFE, MRNA, and BAC (see here).

The stock market lost momentum since December 2021 while the oil industry has gained following the increasing market volatility, inflation, interest rates, world events, and other dynamics.

In this Part 2, the trends have changed. Compared to Dec 2022, most stocks have maintained a positive momentum, especially the technology stocks such as AAPL, GOOG, TSLA, META, NVDA, AMD, SOFI, NFLX and others such as UBER, and ABNB. Healthcare and Banking, including PFE, MRNA,JPM, C, and BAC have also started to regain an upward trend. Although mostly below the Dec 2021 levels, positive improvements are observed.

The indices have experienced improving trend with the following performances, as Dec 22, 2023 vs Dec 2021 and Dec 2022:

- NASDAQ Composite (^IXIC): -4% and 43%

- Dow Jones Industrial Average (^DJI): -3% and 13%

- S&P 500 (^GSPC): -0% and 24%

- Crude Oil index (CL=F): -1% and - 6%

- Russell 2000 (^RUT): -9.0% and 15%

- Gold Dec 23 (GC=F): 13% and 13%

- Silver Dec 23 (SI=F): 5% and 3%

- CBOE Interest Rate 10 Year T No (^TNX): 158% and 1%

For More Proceed to the main article here: AroniSmartIntelligence™ in Action: Stock Performance Analysis with Sentiment Analysis, Support Vector Machine and Dominance Analysis in Q4 2023 - Part 2.

More detailed analyses can be conducted using AroniSmartIntelligence™ Big Data, Machine Learning, Time Series and Sentiment Analysis capabilities.

For more on AroniSmartIntelligence™ and AroniSmartInvest™ capabilities, visit AroniSoft web site by clicking here. AroniSmartInvest™ and AroniSmartIntelligence ™ are available on Apple's App Store.

©2023 AroniSoft LLC.

Advertisement

GET ARONISMARTINTELLIGENCE™ on App Store

AroniSmartIntelligence™, the leading tool for Advanced Analytics, Machine Learning & Data Science

Statisticians, Data Scientists, Business and Financial Analysts, Savvy Investors, Engineers, Researchers, Students, Teachers, Economists, Political Analysts, and most of the practitioners use Advanced Analytics to answer questions, to support informed decision making or to learn.

AroniSmartIntelligence™ is a leading Advanced Analytics, Machine Learning and Data Science tool, with optimized cutting edge Statistics models, Econometrics, Big Data and Text Analytics.

AronismartIntelligence™ includes modules covering Machine Learning and Big Data mining, Unstructured Text Analysis, Sentiment and Emotion Analytics, Bayesian Statistics and other advanced analytics.

Comments

Post a Comment